MAKE YOUR FREE Shareholders' Agreement

What we'll cover

What is a Shareholders' Agreement?

When should I use a Shareholders' Agreement?

- when you and other individuals are shareholders in a private limited company that has ordinary shares only

- to supplement the company's Articles of association (ie articles) with provisions relating to shareholders' powers and entitlements

- to keep these additional provisions confidential, in a private contract

- to make it easier to change provisions in the future without having to amend the company’s articles

Sample Shareholders' Agreement

The terms in your document will update based on the information you provide

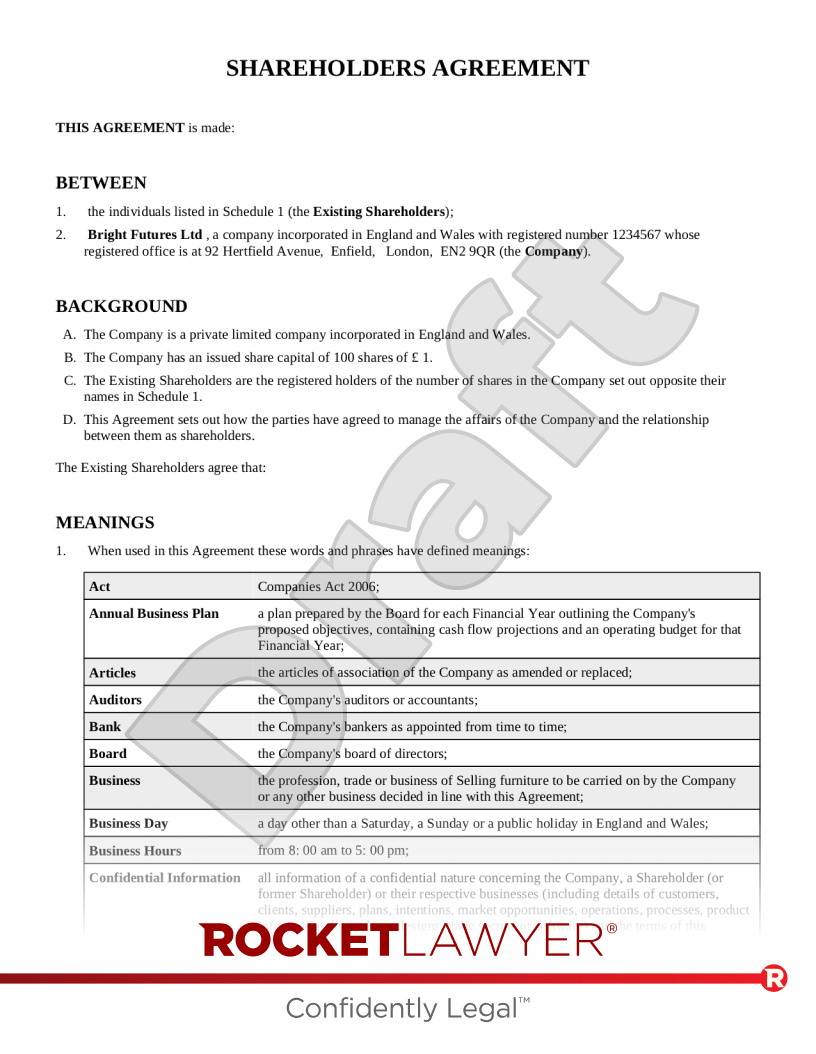

SHAREHOLDERS' AGREEMENT

THIS AGREEMENT is made:

BETWEEN

- the individuals listed in Schedule 1 (the Existing Shareholders);

- , a company incorporated in with registered number whose registered office is at , (the Company).

BACKGROUND

- The Company is a private limited company incorporated in .

- The Company has an issued share capital of shares of £.

- The Existing Shareholders are the registered holders of the number of shares in the Company set out opposite their names in Schedule 1.

- This Agreement sets out how the parties have agreed to manage the affairs of the Company and the relationship between them as shareholders.

The Existing Shareholders agree that:

MEANINGS

- When used in this Agreement these words and phrases have defined meanings:

Act Companies Act 2006; Annual Business Plan a plan prepared by the Board for each Financial Year outlining the Company's proposed objectives, containing cash flow projections and an operating budget for that Financial Year; Articles the articles of association of the Company as amended or replaced; Auditors the Company's auditors or accountants; Bank the Company's bankers as appointed from time to time; Board the Company's board of directors; Business the profession, trade or business of to be carried on by the Company or any other business decided in line with this Agreement; Business Day a day other than a Saturday, a Sunday or a public holiday in England and Wales; Business Hours from : to : ; Confidential Information all information of a confidential nature concerning the Company, a Shareholder (or former Shareholder) or their respective businesses (including details of customers, clients, suppliers, plans, intentions, market opportunities, operations, processes, product information, know-how, designs, trade secrets or software) and the terms of this Agreement; Clear Days in relation to a period of notice or other communication, that period excluding the day when the notice or communication is given and the day it takes effect; Director a Director of the Company; Distributable Profits the amount of the Company's profits available for distribution to Shareholders under the Act; Expenditure Limit £ ; Financial Year the Company's financial year for accounting purposes; Intellectual Property all patents, rights to inventions, copyright and neighbouring and related rights, moral rights, trade marks, service marks, business and domain names, goodwill, rights in designs, rights in computer software, database rights, confidential information (including trade secrets and know-how) and all other intellectual and industrial property and similar rights, whether registered or unregistered, and including (a) all renewals or extensions of these rights and (b) all applications and rights to apply for and be granted these rights which subsist in any part of the world; Leaving Date the date a Shareholder stops being a Shareholder; Leaving Shareholder a Shareholder who transfers their Shares and stops being a Shareholder; Model Articles the articles of association contained in Schedule 1 to the Companies (Model Articles) Regulations 2008; Reserved Matters any matter referred to in the Reserved Matters section of this Agreement; Shareholders Shares ordinary shares of £ each in the capital of the Company; and Start Date . - In this Agreement, unless the context means a different interpretation is needed:

- including means "including without limitation";

- words denoting the singular include the plural and vice versa, and words denoting one gender include all genders;

- a person includes firms, companies, government entities, trusts and partnerships;

- a party means a party to this Agreement and includes its assignees and successors in title and, in the case of an individual, to their estate and personal representatives;

- reference to a Section, paragraph or Schedule is to a Section, paragraph or Schedule of or to this Agreement (and the Schedules form part of this Agreement);

- reference to a statute or statutory provision includes any modification of or amendment to it, and all statutory instruments or orders made under it;

- reference to the time of day is to a time in London; and

- reference to writing or written includes faxes and email but not any other type of electronic communication.

- The headings in this document are for convenience only and do not affect the interpretation of this Agreement.

PRELIMINARIES

Start and Duration

- This Agreement:

- takes effect on the Start Date;

- will continue in effect until the Company's winding up begins; and

- will bind each Shareholder as long as they continue to be a Shareholder, but subject to the Miscellaneous section below.

- The Company will carry on the Business and continue until wound up in line with the Act.

Administration

- The Directors of the Company will initially be the individuals listed in Schedule

- Unless otherwise agreed by the Board:

- the registered office of the Company will be , ;

- the Business will initially be carried on from , ; and

- the Auditors of the Company will be such auditors or accountants as may be appointed by the Board in any Financial Year.

Articles of Association

- On the Start Date, the Company's Articles are the Model Articles.

Warranties

- Each Shareholder warrants to the other Shareholder that they can accept and perform their obligations under this Agreement without being in breach of any other obligation they are bound by.

ACCOUNTING AND FINANCIAL MATTERS

Accounting

- The accounting reference date of the Company will be the of in each year.

- The Company must maintain complete and accurate accounting and other financial records giving a true and fair view of the Business, the state of affairs and the profit and loss of the Company.

- The accounting and other financial records will be kept at the Company's registered office or principal place of business (or any other place the Board decides) and will be open to inspection by the Directors during Business Hours on Business Days.

Banking Arrangements

- The Bank is the Company's banker as appointed from time to time.

- The Company's bankers will be the Bank.

- All money and payments received by or on behalf of the Company must be paid promptly into the Company's bank account and all securities for money must be promptly deposited in the Company's name with the Bank.

- All cheques or instructions for the electronic transfer of money from any account of the Company with the Bank must be in the Company's name and can be drawn or given:

- for amounts up to and including the Expenditure Limit, by any one Director; and

- for amounts over the Expenditure Limit, by two Directors.

In the case of instructions for electronic transfer, written confirmation of those instructions will be signed by the authorising Director(s).

Funding

- No Shareholder will be obliged to subscribe for additional shares in the Company or provide additional funding to the Company (other than Shares they have agreed to).

- Additional funding required by the Company will be borrowed from the Bank or from other normal sources on terms agreed in writing by all the Shareholders.

- If a loan is not available on terms acceptable to all the Shareholders, any funds advanced to the Company by any Shareholder will be a loan on terms to be agreed with the other Shareholders. Any loan made to the Company by a Shareholder will be interest-free and unsecured unless otherwise agreed by all the other Shareholders.

- Any guarantees or indemnities given by the Shareholders for obligations of the Company must be given jointly and severally by all the Shareholders.

Dividend Policy

- No dividend will be declared or paid to any Shareholder while any loans from any Shareholder are outstanding.

SHARES

Issues of Additional Shares

- If the Company wishes to issue Shares in addition to those provided for in this Agreement, the Shareholders will ensure (as far as lawfully possible) that the Company gives notice to each Shareholder stating the number of Shares to be issued and the issue price per Share (the Issue Notice).

- Each Shareholder can (but is not obliged to) subscribe at the price stated in the Issue Notice for a number of Shares in proportion to their existing shareholding. The option must be exercised by notice to the Company at any time within 15 Business Days following the Issue Notice accompanied by payment for the Shares.

- The Company can issue as it sees fit any Shares referred to in the Issue Notice that the Shareholders do not take up as long as the issue is completed within 25 Business Days after the Issue Notice.

- If Shares are to be issued to any person not already a Shareholder, the issue will not happen until the proposed Shareholder has signed a deed of adherence agreeing to be bound by this Agreement from the date they become a Shareholder.

Transfer of Shares

- No Shareholder can sell or transfer any Share (or any interest in any Share) except in line with the following paragraphs.

- A Shareholder can transfer all or any of their Shares (or any interest in any Share) with the written consent of all the other Shareholders.

- Unless they have the consent of all the other Shareholders, a Shareholder who wishes to transfer any of their Shares (the Seller) to another person must give written notice (a Seller's Notice) to the Company and the other Shareholders (the Continuing Shareholders). Each Seller's Notice must state the number of Shares the Seller wishes to transfer (the Sale Shares), details of the person they intend to transfer the Sale Shares to, the proposed price per Sale Share (the Sale Price) and any other specific terms.

- Each Continuing Shareholder can (but is not obliged to) apply to buy any number of the Sale Shares at the Sale Price and on any other specific terms stated in the Seller's Notice. The option must be exercised by notice to the Company at any time within 15 Business Days of the Seller's Notice.

- If there is competition between the Continuing Shareholders for the Sale Shares, the Sale Shares will be treated as offered to the Continuing Shareholders who accepted in proportion (as nearly as possible) to their existing holdings of Shares (the Proportionate Allocation).

- A Continuing Shareholder can indicate they would be willing to buy a particular number of Shares in excess of their Proportionate Allocation (Extra Shares) when applying for Sale Shares.

- The Company will allocate the Sale Shares as follows:

- if the total number of Sale Shares applied for by the Continuing Shareholders is greater than the available number of Sale Shares:

- each Continuing Shareholder will be allocated their Proportionate Allocation or (if less) the number of Sale Shares they applied for; and

- Extra Shares will be allocated in line with the applications or, if there is competition for the Extra Shares, among the Continuing Shareholders applying for Extra Shares in proportion (as nearly as possible) to their existing share of all the issued Shares of the Company excluding the Sale Shares; or

- if the total number of Sale Shares applied for by the Continuing Shareholders is equal to or less than the available number of Sale Shares, each Continuing Shareholder will be allocated the number applied for in line with their application and any remaining Shares can be sold to the intended buyer set out in the Seller's Notice.

- if the total number of Sale Shares applied for by the Continuing Shareholders is greater than the available number of Sale Shares:

- After allocating the Sale Shares, the Company must give notice in writing (a Sale Notice) to the Seller and to each person that Sale Shares have been allocated to. The Sale Notice must state the number of Sale Shares allocated to each person and the price payable. Completion of the transfer of the Sale Shares in line with the Sale Notice will happen within five Business Days of the date of the Sale Notice.

- If Shares are to be transferred to any person not already a Shareholder, the transfer will not happen until the proposed Shareholder has signed a deed of adherence agreeing to be bound by this Agreement from the date they become a Shareholder.

- The Board will approve for registration any transfer of Shares which complies with this Section and all other applicable laws, rules and regulations, and decline to approve for registration any other transfer of Shares.

Compulsory Transfer

- A Shareholder will be deemed to have served a valid Seller's Notice relating to all of their Shares

- if that Shareholder:

- dies;

- becomes a patient under the Mental Health Act 1983 or 2007;

- if that Shareholder:

- commits persistent breaches of this Agreement;

- is also a Director or employee and has their directorship or employment terminated due to their dishonesty, gross misconduct or neglect, fraud or illegal activities or any other ground for summary dismissal (other than in circumstances of proven unfair dismissal).

- if that Shareholder:

- The Seller's Notice will be deemed to have been given to (and received by) the Company and the other Shareholders on the day the event occurred. The Sale Price will be taken to be:

- the fair value of the Shares where the event triggering the Seller's Notice is mentioned in paragraph (a) immediately above; and

- the fair value or nominal value of the Shares (whichever is less) where the event triggering the Seller's Notice is mentioned in paragraph (b) immediately above.

The procedure set out in the Transfer of Shares section above then applies.

Share Valuation

- The fair value of any Sale Shares referred to in the above paragraph will be the amount the Auditors (or an independent accounting firm engaged for this purpose if auditors or accountants have not otherwise been appointed) determine is, in their opinion, the fair value of those Sales Shares on the date of the notice exercising an option to apply for Sale Shares:

- between a willing buyer and a willing seller contracting on arm's length terms;

- assuming the Company will continue carrying out the Business; and

- ignoring that the Sale Shares represent a minority or a majority interest in the Company.

MANAGEMENT

The Board

- Any question arising at any meeting of the Board, other than Reserved Matters, will be decided by a majority of votes of the directors present.

- The Board can decide matters by written resolution of all the Directors and can establish committees in line with the Articles.

- Meetings of the Board will be held at least times a year.

- Unless otherwise agreed in writing by all the Directors, at least 14 Clear Days' notice of each meeting will be given to all the Directors.

- Each meeting notice will specify the time, date and venue of the Board meeting and will outline the matters to be discussed. No matters will be resolved at any Board meeting except those specified in the meeting notice unless all the directors agree otherwise.

- Directors can attend a Board meeting by telephone or video conferencing unless the Articles say otherwise.

- The quorum for each Board meeting will be Directors present (in person or by telephone or video conferencing). If a quorum is not present within 30 minutes of the time appointed, or if during a meeting a quorum is no longer present, the meeting will be adjourned to the same time and place on the seventh day after the original meeting. If a quorum is not present at the adjourned meeting within 30 minutes from the time appointed, the adjourned meeting will be dissolved.

- Minutes of each meeting will be prepared, approved by the Directors at the next meeting and signed by the chairman as evidence of the proceedings.

Shareholder Meetings

- Any question arising at a Shareholder meeting will be decided in line with the Articles.

- The Shareholders can decide matters by written resolution of all the Shareholders eligible to vote on the resolution to be proposed.

- All voting of the Shareholders will be by a show of hands of those Shareholders present and entitled to vote on the resolution, unless a poll vote is requested. A poll vote can be demanded by:

- the chairman of the meeting;

- at least two Shareholders entitled to vote on the resolution; or

- Shareholders holding not less than 10% of the issued share capital.

- Shareholder meetings will take place when requested by any of the Directors or Shareholders. Unless otherwise agreed in writing by all the Shareholders, at least 14 Clear Days' written notice of the meeting will be given to all the Shareholders entitled to attend and vote.

- Each meeting notice will specify the time, date and venue of the meeting and will outline the matters to be discussed.

- The quorum for each Shareholder meeting will be Shareholders present. If a quorum is not present within 30 minutes of the time appointed, the meeting will be adjourned to the same time and place on the seventh day after the original meeting. If a quorum is not present at the adjourned meeting within 30 minutes from the time appointed the adjourned meeting will be dissolved.

Day-to-Day Management

- The Directors will be responsible for the day-to-day control, policy and direction of the Company. The Directors will perform the duties delegated to them by the Board and report to the Board as required by the Board.

- The Business and affairs of the Company will be managed by the Board and decisions will be decided by a majority vote except as specifically stated in this Agreement.

- The chairman of the board will have a casting vote.

- The Directors will prepare an Annual Business Plan for each Financial Year.

Reserved Matters

- The Shareholders must ensure as far as lawfully possible that the Company does not do any of the following without the consent of all the Shareholders (either obtained at a Shareholder meeting or in writing):

- change the Articles;

- stop being a private company limited by shares;

- change the Company's name;

- change the nature or scope of the Business;

- carry out the Business other than in the ordinary course of business on an arm's length basis;

- change the Company's accounting reference date;

- pass any resolution or take any action for the winding up, administration, receivership, dissolution or liquidation of the Company;

- carry out any reconstruction or amalgamation, enter into any scheme of arrangement or make any arrangement with its creditors generally;

- borrow, increase the level of any overdraft facility or obtain any other finance;

- create or grant any mortgage, encumbrance or other security over the whole or any part of its assets (other than liens in the ordinary course of business);

- lend money to any person;

- guarantee the debts of any person;

- sell or dispose of the whole or a large part of the Company's assets (whether by one transaction or a series of transactions);

- acquire the whole or part of any other company or business;

- buy, sell, lease or let a property or interest in a property;

- buy any capital item or connected items exceeding £ ;

- pay or declare any dividend other than as set out in this Agreement;

- enter into any contract of an unusual or long-term nature or with a value exceeding £ ;

- engage any person as an employee, consultant or agent with a yearly salary or pay of more than £ or increase (or agree to increase) the yearly salary or pay of a director, employee, consultant or agent by more than £ ;

- start any legal proceedings (other than debt recovery in the ordinary course of business);

- grant any options over any of its share capital;

- alter, reorganise or grant any rights relating to its share capital; or

- have an accounting period of anything other than 12 months.

SHAREHOLDER OBLIGATIONS AND ENTITLEMENTS

Duties

- Each Shareholder must act in good faith towards the others in promoting the Business and carrying out this Agreement.

- Each Shareholder will use reasonable efforts to promote and develop the Business to the Company's best commercial advantage.

- Each Shareholder must comply with all applicable laws, statutes, regulations and codes relating to anti-bribery and anti-corruption, including the Bribery Act 2010.

Confidentiality

- Except as set out below in this section, the Shareholders must not at any time disclose any Confidential Information to any other person or use it for any purpose other than in the performance of their obligations as Shareholders. This obligation of confidentiality will continue to bind a Shareholder after they cease to be a Shareholder.

- The obligation of confidentiality in the previous paragraph will not apply to information that is or becomes generally available to the public (other than as a result of its disclosure by a Shareholder in breach of this Agreement).

- A Shareholder can disclose Confidential Information to:

- a governmental, regulatory or other authority if disclosure is required by law, court order or a duty imposed by a regulatory authority;

- his professional advisors; or

- the professional advisers of the Company.

Obligations on Leaving

- Each Leaving Shareholder must pay into the Company's bank account immediately all sums due from them to the Company.

- Each Leaving Shareholder must return to the Company all accounting records, letters and other documents in their possession relating to the Company which are needed for the continuing conduct of the Business.

- Each Leaving Shareholder must promptly do everything and sign all documents reasonably requested by the Company (and at the Company's sole expense) to transfer to it any property or assets owned by the Leaving Shareholder as nominee for or in trust for the Company.

Intellectual Property

- The Company owns absolutely any Intellectual Property created or discovered by a Shareholder which relates to the Business or can be used in the Business (other than Intellectual Property which the Shareholders, acting reasonably and in good faith, agree was not connected with and did not in any way affect or relate to the Business as at the date of its creation or discovery and was not intended to be connected with or otherwise so affect or relate to the Business).

- Shareholders must promptly notify the Company of all Intellectual Property they have created (or partly created) and which relates to the Business or can be used in the Business. All this Intellectual Property will vest in the Company automatically on creation (and if it does not, the relevant Shareholder(s) will hold it on trust for the Company). Shareholders must, at the Company's sole expense, promptly do everything and sign all documents necessary to transfer ownership of this Intellectual Property to the Company and enable the Company to enforce its Intellectual Property.

GENERAL

Status of This Agreement

- This Agreement will prevail if any of its provisions conflict with anything in the Articles. Any Shareholder can require that the Shareholders amend the Articles to bring them in line with this Agreement.

- Each Shareholder will exercise their voting rights and other powers of control relating to the Company to ensure this Agreement is observed in line with its spirit and the parties' intentions.

Assignment

- Shareholders cannot assign, sub-contract or in any other way transfer to any third party the benefit and/or burden of this Agreement without the prior written agreement of all the other Shareholders (who cannot withhold consent unreasonably).

Notices

- Any notice (other than in legal proceedings) to be given under this Agreement must be in writing and delivered by handing it personally, in the case of a Shareholder, to the Shareholder in question, or by posting pre-paid first class post to or by leaving it by hand delivery at the registered address of the Company or, in the case of a Shareholder, at the last known address of such Shareholder or by sending it by email to the business email address of the chief executive or equivalent in the case of the Company and in the case of a Shareholder, that Shareholder's email address as notified by the Shareholder in question as being an address at which such Shareholder is prepared to accept service of notices.

- Notices which are:

- sent by post will be deemed to have been received, where posted from and to addresses in the United Kingdom, on the second Business Day after the date of posting, and where posted from or to addresses outside the United Kingdom, on the tenth Business Day after the date of posting;

- delivered by hand will be deemed to have been received at the time the notice is left at the proper address; and

- sent by email will be deemed to have been received on the next Business Day after sending.

Company Communications

- The Shareholders agree to the use by the Company of electronic communications when communicating with the Shareholders at the Company's discretion.

Entire Agreement

- This Agreement contains the whole agreement between the parties relating to its subject matter and supersedes all prior discussions, arrangements or agreements that might have taken place concerning the Agreement. Nothing in this paragraph limits or excludes any liability for fraud or fraudulent misrepresentation.

Variation

- No variation to this Agreement will be valid or binding unless it is recorded in writing and signed by or on behalf of the parties.

No Partnership or Agency

- This Agreement does not create a partnership between any of the Shareholders.

- Nothing in this Agreement makes any Shareholder an agent of any other Shareholder.

Miscellaneous

- The Contracts (Rights of Third Parties) Act 1999 will not apply to this Agreement and no third party will have any right to enforce or rely on any provision of this Agreement.

- No delay, act or omission by a party in exercising any right or remedy will be deemed a waiver of that, or any other, right or remedy.

- Provisions which, by their intent or terms, are meant to survive the termination of this Agreement will do so.

- If any court or competent authority finds that any provision of this Agreement (or part of any provision) is invalid, illegal or unenforceable, that provision or part-provision will, to the extent required, be deemed to be deleted, and the validity and enforceability of the other provisions of this Agreement will not be affected.

Further Assurance

- Each party will do everything and sign all documents reasonably necessary to give effect to this Agreement.

Governing Law and Jurisdiction

- This Agreement shall be governed by and interpreted according to the law of England and Wales and all disputes arising under the Agreement (including non-contractual disputes or claims) shall be subject to the exclusive jurisdiction of the English and Welsh courts.

This Agreement has been executed as a deed on the day and year first before written.

| Executed as a deed by | |

| , Shareholder | |

| in the presence of: | |

| Witness signature | |

| Name of witness | |

| Address | |

| Occupation | |

SCHEDULE

Existing Shareholders

SCHEDULE

Initial Directors

About Shareholders’ Agreements

Learn more about making your Shareholders’ Agreement

-

How to make a Shareholders’ Agreement

Making your Shareholders’ Agreement online is simple. Just answer a few questions and Rocket Lawyer will build your document for you. When you have all the information about the company and its procedures prepared in advance, creating your document is a quick and easy process.

You’ll need the following information:

The company

-

What is the company’s name and number?

-

What’s its registered address? If different, what is its business address?

-

What’s its key purpose (ie its business description)?

-

When does its business day start and end?

Shares and shareholders

-

What is the company’s issued share capital? You’ll need to enter the total number of shares issued and the nominal value of each share.

-

Who are the current shareholders? You’ll need each shareholder’s name, address, and number of shares owned.

-

Are any new shareholders coming on board? If so, what are their names and addresses? How many shares are they subscribed to (ie shares they’ve promised to purchase) and at what price?

Other personnel

-

Who are the company’s directors?

-

Does the company have a chairperson for the board of directors? If so, what is their name? Do they have a casting vote (ie an additional vote if required to break a deadlock)?

-

Does the company have a company secretary? If so, what’s their name?

-

Does the company have appointed accountants? If so, what’s the accountancy company called?

-

Does the company have an appointed bank? If so, what’s it called?

Meetings and decisions

-

What’s the minimum number of board meetings the company must hold per year?

-

How many directors are required for a meeting to take place?

-

How many shareholders are required for a meeting to take place?

Finances and accounting

-

What is the company’s accounting reference date (ie the end of its accounting year)?

-

Are there any shareholder loans (ie money lent by a shareholder to the company)? If so, who provided them and how much are they for?

-

Without shareholder approval, what’s the company’s maximum capital expenditure allowed per item? What about spend per contract?

-

What’s the company’s maximum annual salary and salary increase, without shareholder approval?

-

Without two directors’ approval, what’s the maximum general company spend?

-

Do shareholders have access to the company’s financial and accounting records?

-

Does the company commit to paying shareholders a certain minimum percentage of distributable profits each financial year as dividends? If so, what is the percentage and within how many months will these dividends be paid?

Leaving the company

-

Do shareholders have to sell their shares and leave the company (ie a compulsory transfer) if they:

-

Are an employee of the company and they resign?

-

Are a director and they resign?

-

Commit a material breach of the Shareholders’ Agreement, which is not remedied within a specified number of days?

-

-

Which restrictions will be imposed on shareholders who leave the company? You may impose restrictions against:

-

Soliciting shareholders, employees, senior employees, and/or customers.

-

Engaging in competing business activities. If this restriction is included, within how many miles of the company’s places of business can the shareholder not participate in competing business activities?

-

Doing business with the company’s customers.

-

The Shareholders’ Agreement

-

On what date will the Shareholders’ Agreement come into effect?

-

How will the company sign the Agreement - by two directors signing, or one director in the presence of a witness? What is/are the director(s) name(s)?

-

If the company is registered in Scotland, will the Agreement be governed by the laws of England and Wales or the laws of Scotland?

-

-

Common terms in a Shareholders’ Agreement

Shareholders’ Agreements set out aspects of how a company is run and how shareholders interact with it. To do this, this Shareholders’ Agreement template includes sections headed:

This Agreement

The Agreement starts by identifying the parties to the Agreement (ie the existing shareholders, new shareholders, and the company).

Background

This introductory section provides some essential information about the company. For instance, where it is incorporated, its issued share capital, and a reference to the Agreement’s schedules for details of the shareholders.

Meanings

This definition table assigns specific meanings to key terms used throughout the Agreement. When these terms (eg ‘Shareholders’, ‘Shares’ or ‘Articles’) are used capitalised throughout the Shareholders’ Agreement, they carry the meaning they’re given in this table.

Preliminaries

This section sets out basic information about the company’s shares and administration. It sets out the timeframe and dates of the Shareholders’ Agreement and identifies key company personnel (eg the directors) and locations.

If new shareholders are coming on board, obligations regarding their purchasing shares are set out in this section. If there are any shareholder loans, these are set out here, by reference to the Agreement’s schedules.

The preliminaries section also identifies the company’s articles of association as the UK’s model articles (ie the standard articles of association set out in The Companies (Model Articles) Regulations 2008. If your company has different articles of association (ie they’ve been modified from the model articles), you can Ask a lawyer for help adapting your Shareholders’ Agreement to reflect this.

Lastly, this section contains a warranty from each shareholder to the other(s), promising that they will perform their obligations under this Agreement without breaching any other binding obligations.

Accounting and financial matters

This section sets out the company’s key obligations related to banking, accounting, funding, and dividends. For example, it sets out the dates of its financial year and rules for making and recording transactions. Funding rules include, for example, when shareholders must agree on taking out a loan.

The ‘dividends‘ subsection sets out a rule that dividends will not be paid whilst any shareholder loans are outstanding. If the company commits to paying out a certain minimum percentage of its distributable profits as dividends each year, this is set out here too.

Shares

This section first sets out rules for what happens if the company wants to issue additional shares. For example, shareholders have an option to subscribe for (ie promise to purchase) a portion of the new shares in proportion to their existing shareholding, before those shares are offered to others.

Rules for the transfer (ie sale and purchase) of existing shares are also set out in this section. For instance, this section explains the notice requirements that must be met when a purchase is planned and the rights and processes available for existing shareholders who want to purchase the shares being sold.

This section also deals with compulsory transfers. It explains which circumstances will trigger a compulsory transfer (eg a shareholder’s death) and how the sale of their shares will then be dealt with (eg how the sale price will be determined).

The final part of this section explains how the fair value (ie as will be used to determine the sale price in certain situations) can be established.

Management

This section deals with meetings and decision-making. For example, it explains:

-

how directors’ and shareholders’ meetings can be called

-

who must be present to hold a meeting (eg how many shareholders, ie ‘quorum’)

-

how votes can take place and what majorities must be met to make certain decisions (eg ordinary or special resolutions)

-

other provisions related to voting, for example, whether the chairperson of the board has a casting vote

Shareholder obligations and entitlements

This section starts by setting out the shareholders’ basic duties under the Agreement. For example, their duty to act to promote the company’s commercial interests and to comply with the law.

This is followed by a confidentiality obligation, whereby shareholders promise not to disclose the company’s confidential information except in certain circumstances. For example, when necessary to perform their obligations as shareholders.

Next, this section sets out shareholders’ obligations when they leave the company (ie sell their shares). This is where any restrictions you choose to impose will be included, for example, non-solicitation or non-compete clauses. Shareholders are also required to settle debts, return company property, and sign necessary documents.

Lastly, this section handles intellectual property provisions. It essentially states that the company owns all intellectual property relevant to itself that shareholders have created.

General

This section deals with various other points of law that govern how this Shareholders’ Agreement operates. For example:

-

stating that this Agreement is the entire agreement, ie the Shareholders’ Agreement contains all of the agreement between the shareholders and the company (ie there are no additional terms). This helps avoid confusion if, for instance, other terms were in contemplation during negotiations

-

stating that this Agreement prevails over provisions in the company’s articles of association, if there is a conflict

-

restricting how the shareholders can deal with the Agreement (eg preventing them from assigning their benefits under the Agreement to others)

-

requiring that any variations to the Agreement must be made in writing

-

excluding the Contracts (Rights of Third Parties) Act 1999 or the Contract (Third Party Rights) (Scotland) Act 2017, except in certain circumstances. This essentially means that third parties (ie not one of the shareholders or the company) that would otherwise be able to enforce obligations under this Agreement under the Act cannot do so

-

setting out how any notices or other similar communications that must be given under the Agreement should be delivered. This includes shareholders’ willingness to receive company communications electronically

-

clarifying that the Agreement does not create a partnership or an agency relationship between shareholders

-

which country’s legal system must be used to resolve any disputes (ie the Agreement’s ‘jurisdiction’). This is necessary as the legal systems of England and Wales and of Scotland are different

This Agreement has been executed as a deed…

The Agreement ends with spaces for the shareholders, the company, and their witnesses to sign the document. It also states that the document is signed as a deed.

Schedule 1 - Existing shareholders

This first schedule sets out the names and addresses of all existing shareholders and how many shares they hold.

Schedule 2 - New shareholders

If new shareholders are coming on board, this schedule sets out their names and addresses as well as how many shares they intend to buy and the sale price.

Schedule 3 - Loans

If there are any shareholder loans, these will be set out here.

Schedule 4 - Initial directors

The names of all company directors will be set out in this schedule.

If you want your Shareholders’ Agreement to include further or more detailed provisions, you can edit your document. However, if you do this, you may want a lawyer to review the document for you (or to make the changes for you) to make sure that your modified Shareholders’ Agreement complies with all relevant laws and meets your specific needs. Use Rocket Lawyer’s Ask a lawyer service for assistance.

-

-

Legal tips for shareholders

Make sure you’ve got other necessary documents in place when starting a company

Shareholders’ Agreements are an important part of forming or organising a company. However, starting a company is a significant undertaking. It is important to make sure you’re organised and transparent to help you comply with relevant laws and to avoid issues down the line. Some of the key legal documents you can make to manage this include:

-

Articles of association - the key document setting out the company’s rules and procedures, as required for incorporation with Companies House

-

Share certificates - proof that the individuals named on the certificates hold the stated shares in the company

For more information, read How to register a company in 5 steps and What happens after you register your company.

Ensure that you meet your legal obligations as a company

If you’re responsible for running a company, it’s important that you meet your legal obligations beyond just having the right initial paperwork. For example, make sure you meet your reporting and tax obligations and follow employment law and consumer commerce and marketing rules.

Understand when to seek advice from a lawyer

In some circumstances, it’s good practice to Ask a lawyer for advice to ensure that you’re complying with the law and that you are well protected from risks. You should consider asking for advice if:

-

you’re starting a company limited by guarantee

-

you’re running a public company (PLC)

-

your company has shareholders who are companies, not individuals

-

your company is incorporated outside England, Wales and Scotland

-

your company has more than one class of share

-

your company’s articles of association are not the model articles

-

Shareholders’ Agreement FAQs

-

What should a Shareholders' Agreement include?

This Shareholders' Agreement template covers:

-

the issue of new shares to incoming shareholders

-

company officers (eg directors)

-

requirements for board and shareholders' meetings

-

requirements for decision-making (eg unanimous shareholder approval for reserved matters)

-

shareholders' duties, entitlements, and management of the company

-

rights of first refusal for shareholders to buy the shares of shareholders leaving the company

-

shareholders' rights to information and dividends

-

what happens when shareholders leave, eg restrictions on competing with the company after leaving

-

-

Why do I need a Shareholders' Agreement?

Shareholders' Agreements aren’t a legal requirement for starting a company and registering it with Companies House. However, it’s a good idea to make a Shareholders’ Agreement to protect each individual's interest in a company and to create rules for how the company will be run, how decisions can be made, and how any disputes between shareholders will be dealt with. For more information, read Shareholders’ agreements.

-

What is issued share capital?

The issued share capital is the total of a company's shares that are currently held by shareholders. For example, 100 shares of £10 nominal value each.

A company can issue new shares at any time, unless a limit is set in the company's articles. For example, companies registered before the Companies Act 2006 came into force (on 1 October 2009) will be subject to an authorised capital figure (ie an authorised share capital), which is the maximum amount of share capital the company is authorised to issue to shareholders unless its memorandum and articles of association are amended.

-

What is nominal value?

The nominal (or par) value of shares is the value chosen for the shares by the initial shareholders when the company is incorporated. The nominal value is determined by the company itself and remains unchanged over time (ie it doesn’t change with the market price). For example, a share may have a nominal value of 1p, 10p, £1 or any other sum in any currency.

-

What are dividends?

Dividends are profits distributed to shareholders according to the number of shares they hold in the company. The company must have adequate distributable profits to pay dividends to its shareholders. This Shareholders' Agreement requires that profits are not distributable (and, therefore, not to be paid out as dividends) if any loans from any shareholders are outstanding. For more information, read Dividends.

-

How are dividends distributed?

Shareholder Agreements usually specify the payment period within which dividends are to be distributed and the minimum percentage of distributable profits that are to be distributed as dividends in each financial year. Alternatively, the directors can decide on the amount to be recommended as a dividend. A more detailed dividend distribution policy is often contained in a company's Articles of association.

-

What is a shareholder loan?

A new or existing shareholder may prefer to lend money to the company rather than buy more shares. It is sensible to record this in a Loan agreement, which will specify whether interest is payable on the loan and whether the loan is secured against the company's assets.

-

What is a compulsory transfer?

A compulsory transfer is when a shareholder must sell their shares to the company’s remaining members. A compulsory transfer may be triggered by various events, for example, when a shareholder:

-

is an employee or director of the company and resigns

-

commits a material breach of the Shareholders' Agreement, which is not remedied

In such circumstances, the price paid for the shares will be the fair value or the nominal value, whichever is less. Fair value is estimated based on an analysis of the company's financial information, including market demand, market price, and any company liabilities or debts.

For more information, read Compulsory transfers of shares.

-

-

What are reserved matters?

Reserved matters are matters for which the company must obtain consent from a special majority (eg a unanimous 100% majority) of the shareholders before making any decisions. Examples of reserved matters include:

-

changes to the company's articles

-

changes to the nature and scope of the business

-

borrowing or obtaining other finance

-

payment or declaration of additional dividends

-

-

How are shares valued?

Valuation of private shares is often required as part of the process of settling shareholder disputes, when shareholders are seeking to exit the business or sell some of their shares, for inheritance purposes, or for various other reasons.

Unlike public companies, whose share prices are widely available, shareholders of private companies have to use a variety of methods to determine the value of their shares. Common methods include using auditors or independent accounting firms.

-

How does a Shareholders' Agreement fit with a company’s articles of association?

A company's Articles of association is a public document, that companies are required by law to have and to adhere to. The articles set out the basics of how the company will be run. They must be submitted when the company first registers with Companies House. By contrast, a Shareholders' Agreement is a private agreement between the shareholders that sets out additional details about how the company will be run. Both documents regulate the actions of the company and can overlap. Companies must, therefore, make sure that they are consistent.

Our quality guarantee

We guarantee our service is safe and secure, and that properly signed Rocket Lawyer documents are legally enforceable under UK laws.

Need help? No problem!

Ask a question for free or get affordable legal advice from our lawyer.