MAKE YOUR FREE Declaration of Trust

What we'll cover

What is a Declaration of Trust?

Declarations of Trust make an express declaration that a property’s co-owners hold the property on trust for themselves and specify the proportions in which they own it. A Declaration of Trust is based on co-owners contributions to the deposit, mortgage, and ongoing maintenance costs.

For use in England and Wales only.

When should I use a Declaration of Trust?

Use this Declaration of Trust:

-

when multiple people are purchasing a freehold or a leasehold property (eg a house or flat) together

-

if all of the purchasers wish to declare their equitable (ie beneficial) shares in the property’s ownership, which are in the same proportions as those by which they contributed to the purchase price

-

if the owners also want to confirm how they will all contribute to mortgage payments, and maintenance costs for the property

-

when purchasing property in England or Wales only

Sample Declaration of Trust

The terms in your document will update based on the information you provide

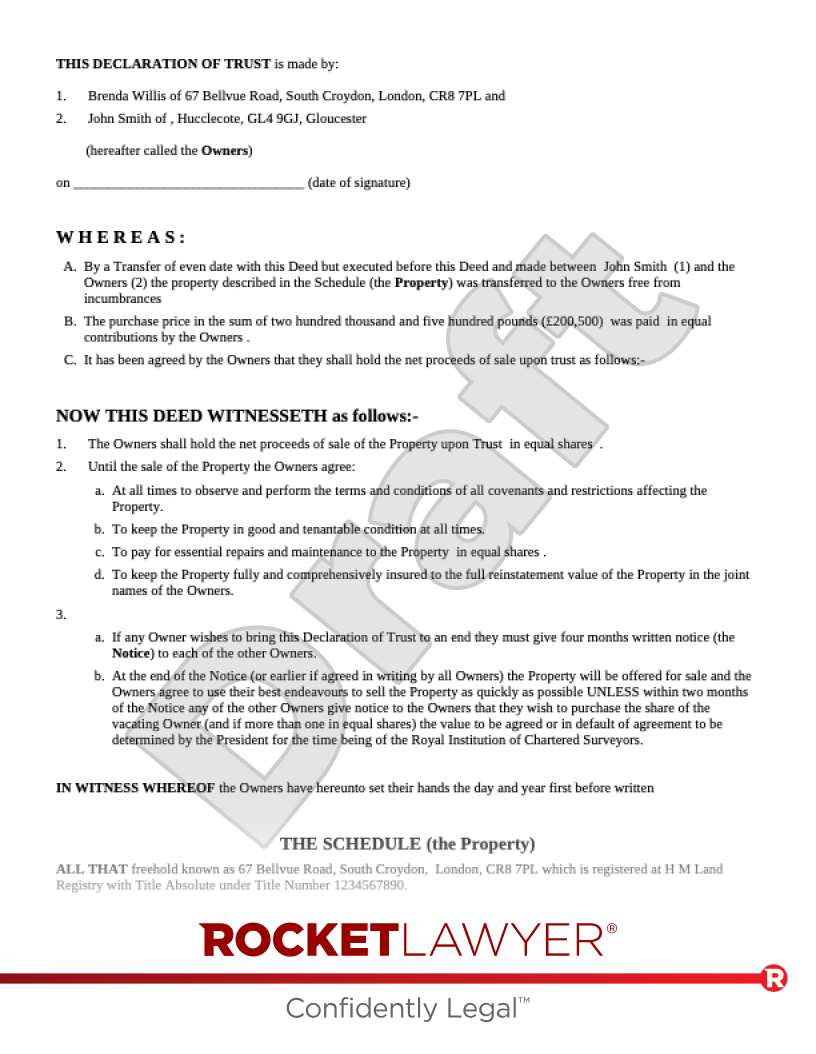

THIS DECLARATION OF TRUST is made by:

(hereafter called the Owners)

on _________________________________ (date of signature)

W H E R E A S :

- By a Transfer of even date with this Deed but executed before this Deed and made between (1) and the Owners (2) the property described in the Schedule (the Property) was transferred to the Owners free from incumbrances

- The purchase price in the sum of (£) was paid as to .

- It has been agreed by the Owners that they shall hold the net proceeds of sale upon trust as follows:-

NOW THIS DEED WITNESSETH as follows:-

- The Owners shall hold the net proceeds of sale of the Property upon Trust as to .

- Until the sale of the Property the Owners agree:

- At all times to observe and perform the terms and conditions of all covenants and restrictions affecting the Property.

- To keep the Property in good and tenantable condition at all times.

- To pay for essential repairs and maintenance to the Property .

- To keep the Property fully and comprehensively insured to the full reinstatement value of the Property in the joint names of the Owners.

-

- If any Owner wishes to bring this Declaration of Trust to an end they must give four months written notice (the Notice) to each of the other Owners.

- At the end of the Notice (or earlier if agreed in writing by all Owners) the Property will be offered for sale and the Owners agree to use their best endeavours to sell the Property as quickly as possible UNLESS within two months of the Notice any of the other Owners give notice to the Owners that they wish to purchase the share of the vacating Owner (and if more than one in equal shares) the value to be agreed or in default of agreement to be determined by the President for the time being of the Royal Institution of Chartered Surveyors.

IN WITNESS WHEREOF the Owners have hereunto set their hands the day and year first before written

THE SCHEDULE (the Property)

ALL THAT leasehold known as , which is registered at H M Land Registry with Title Absolute under Title Number .

About Declarations of Trust

Learn more about making your Declaration of Trust

-

How to make a Declaration of Trust

Making your Declaration of Trust online is simple. Just answer a few questions and Rocket Lawyer will build your document for you. When you have all the information about the owners’ shares and contributions prepared in advance, creating your document is a quick and easy process.

You’ll need the following information:

The owners

-

What are the names and addresses of all of the owners?

-

Who sold the property to the owners? You’ll need the names of all of the sellers if the property was sold by co-owners.

The property

-

What is the property’s address?

-

What is its title number? This can usually be found on the title register at the Land Registry, on the contract of sale, or on the deed of transfer.

-

Do the owners own the freehold or a leasehold of the property?

-

Will there be a rule that guests (ie anyone but the owners) can only stay at the property with the consent of all of the owners?

Expenses and contributions

-

How much did the owners purchase the property for?

-

Did the owners contribute equally to the purchase price?

-

If not, in what proportions did they contribute? You can choose to take into account stamp duty and other purchase fees when calculating the proportions.

-

-

In what proportions will the owners contribute to repair and maintenance expenses? This may be the same or different to the purchase proportions.

-

If not in equal shares, in what proportions will they contribute?

-

-

Did the owners use a loan or mortgage to pay part of the purchase price? If so:

-

Who provided the loan or mortgage? You’ll need their name (eg business name) and address.

-

How much was the loan or mortgage for?

-

In what proportions will the owners contribute to repayments? If not in equal shares, in what proportions will they contribute?

-

-

-

Common terms in a Declaration of Trust

Declarations of Trust set out co-owners’ past and future financial contributions to their property and determine the shares by which they own it. To do this, this Declaration of Trust template includes sections covering:

The owners

The first section sets out exactly who the property’s owners are. Remember that the beneficial owners and legal owners are the same people if you’re using this template - if there are additional beneficial owners who aren’t legal owners, use a Declaration of trust beneficial interest instead. These owners are the parties making the Declaration of Trust. They must all sign it.

Date of signature

The date that the last owner signs the document should be recorded here.

‘Whereas’

This section essentially identifies the sale of the property to which this Declaration of Trust applies. It does this by specifying the seller and the purchaser (ie the owners) of the transaction and the purchase price. If part of the purchase price was paid by mortgage or loan, this will be identified here.

This section also states that the transfer (ie of the property to the owners) is ‘of even date with this Deed’. This means that, once executed, this Declaration of Trust (ie the deed) will be considered as of the same date of the transfer (ie the shares by which the Declaration of Trust say the owners own the property will apply from the date that the transfer was made).

The section states that the transfer is also ‘free from incumbrances’, meaning that there should be no undisclosed third-party rights over the property (eg other trusts).

‘Now this deed witnesseth as follows’

This is the core of the Declaration of Trust. It states the shares in which the owners will receive the proceeds of sale for (ie own) the property. This will either be in equal shares or in specific proportions. If it’s in specific proportions, these will match the proportions in which the owners are stated to have contributed to the purchase price of the property.

The section next sets out various commitments that the owners are making by signing the Declaration of Trust. These include:

-

a commitment to repaying any mortgage or loan in certain proportions. These proportions may be different to the proportions by which the owners own the property

-

promises to pay and follow the conditions of a mortgage, to keep the property in good habitable condition, and to adequately insure it

-

a commitment to paying for essential repairs and maintenance for the property in either equal or specified shares. These proportions may be different to the proportions by which the owners own the property

-

an optional promise not to allow anyone else to stay in the property without the consent of all other owners

Ending the Declaration of Trust

The two terms under point ‘3’ deal with ending the Declaration of Trust. They impose a 4-month notice period on the owners, meaning that if an owner wishes to stop owning their share and no longer be bound by the Declaration of Trust, they need to give 4 months’ notice of this to all of the other owners, after which point the property should be put up for sale.

The document provides for an alternative to sale. The section states that, if another owner wants to take the departing owner’s share and they give the other owners notice of this within 2 months of the departing owner’s original notice, they can generally do so.

‘In witness whereof…’

This sentence precedes the signatures and essentially highlights that the parties are signing the document to confirm its contents.

The Schedule (the Property)

This schedule to the document clearly identifies the property to which the Declaration of Trust relates.

Signatures

The signature section provides spaces for all of the owners to sign and for each owner’s witness to sign and provide their details. It explicitly states that the document is executed as a deed. For more information on signing, see the Make it legal checklist.

If you want your Declaration of Trust to include further or more detailed provisions, you can edit your document. However, if you do this, you may want a lawyer to review the document for you (or to make the changes for you) to make sure that your modified Declaration of Trust complies with all relevant laws and will be enforceable. Use Rocket Lawyer’s Ask a lawyer service for assistance.

-

-

Legal tips for owners

Take care when calculating your proportions

Property ownership is often a complex endeavour. Many different expenses can be involved, such as mortgage payments, purchase fees like stamp duty, renovation and repair costs, utility and living costs, taxes (eg council tax) and more. Allocating payments can be further complicated by complex interpersonal situations. It’s important, therefore, to consider all of the owners’ relationships and financial situations (eg past and expected future contributions) as a whole when deciding how a property’s ownership will be shared.

Understand when to seek advice from a lawyer

In some circumstances, it’s good practice to Ask a lawyer for advice to ensure that you’re complying with the law and that you are well protected from risks. You should consider asking for advice if:

-

you want help working out the appropriate shares by which to divide a property’s ownership

-

you want to specify unequal ownership shares but you’re currently equitable joint tenants (which means that, when you die, your co-owner(s) automatically inherit your property and you cannot leave your share to someone else in your will). You can sever your joint tenancy and then complete a Declaration of Trust

-

you are buying a property that you want to own in unequal shares but you have children together

-

Declaration of Trust FAQs

-

What's included in a Declaration of Trust?

This Declaration of Trust template covers:

-

the property, owners, and seller of the relevant transaction

-

the owners’ contributions to the property’s purchase price

-

the owners’ promised contributions to future mortgage payments and repair and maintenance expenses

-

the proportions in which the owners hold the beneficial interest in (ie actual ownership of) the property

-

the owners’ other promises to each other in relation to the property

-

-

Do I need a Declaration of Trust?

You need a Declaration of Trust if you are buying a property jointly with one or more other people and you want to specify the distinct shares by which you will own the property. This allows the owners to receive these specific proportions of the proceeds of any future sale of the property.

Creating a Declaration of Trust using this template also makes it possible for owners to leave their distinct shares of the property to someone in their wills, as it makes them tenants in common. This is not possible if they are joint tenants. For more information on joint tenants and tenants in common, see the FAQ ‘How do Declarations of Trust work?’.

If you want to set out the beneficial interests of a property’s owners and another person (ie someone who is not also a legal owner of the property), you should use a Declaration of trust beneficial interest.

-

How do Declarations of Trust work?

Declarations of Trust rely on a variety of established legal concepts. No in-depth legal understanding is required to make a Declaration of Trust, but it can be helpful to understand some of the key terms and ideas involved.

Declarations of Trust set out how the beneficial (or equitable) ownership of a property will be shared. The beneficial owner (or ‘real’ owner) of something is the person who receives the benefits of owning it (eg rights to use it and receive interest payments accumulated by it), regardless of whether they are listed as the thing’s legal owner or not. The legal owner is the person who holds the legal title to something (eg they’re listed as the legal owner at the Land Registry and/or on a property’s title deeds). If somebody has a beneficial interest in something, the thing’s legal owner will hold that thing ‘on trust’ for the beneficial owner. This means that they hold and must manage the property for the benefit of the beneficial owner. The legal and beneficial owner of something can be the same or a different person (or people).

If multiple people purchase real property together (eg a house), they will always own the legal interest as ‘joint tenants’. This means that they will always own the legal interest jointly (ie all together) and equally. The beneficial interest, however, can be held as joint tenants or as ‘tenants in common’. Tenants in common hold property in distinct shares, which can be equal or unequal. If you create a Declaration of Trust using this template, the owners listed will all own part of the beneficial interest in the property as tenants in common. You can specify the shares in which they own it.

Note that the use of the word ‘tenant’ here has nothing to do with tenancy agreements or leases. Joint tenants and tenants in common can be the owners of a freehold property (ie when there is no tenancy/lease).

Whether a property is held as joint tenants or tenants in common also has implications for how ownership is passed on when a tenant dies. For more information, read Co-ownership of property.

-

Does a Declaration of Trust affect the owners’ obligations to other parties?

A Declaration of Trust is a purely personal agreement and any obligations owners have to, for example, their mortgage lender will always remain joint and several, regardless of the beneficial interests stated in this document. This means that, if one of the owners fails to pay the mortgage, the other(s) is/are responsible for the debt.

-

How many parties can enter into a Declaration of Trust?

Any number of parties can enter into a Declaration of Trust. Remember, however, that this Declaration of Trust is designed to be used by all of a property’s legal owners and nobody else - so the number of people who can use this declaration is limited to the number of people purchasing the property.

-

Do I need to register this Declaration of Trust?

Once the Declaration of Trust is complete, it should be registered at the Land Registry. This is not compulsory but it is recommended to provide evidence of the true (ie beneficial) ownership of the property.

The Declaration of Trust can be registered by completing Form TR1, including the Declaration of Trust panel (during a house purchase), or Form JO (to be used in the absence of a transfer or lease). Completed forms should be sent to the Land Registry.

-

How can an owner leave this Declaration of Trust?

An owner can leave this Declaration of Trust by giving 4 months' written notice to each of the other owners. If this occurs, the property should be put up for sale at the end of the notice period, unless one of the other owners wants to purchase the departing owner’s share in the property. If the property sells, the purchase price should be shared between the owners in the agreed shares.

Our quality guarantee

We guarantee our service is safe and secure, and that properly signed Rocket Lawyer documents are legally enforceable under UK laws.

Need help? No problem!

Ask a question for free or get affordable legal advice from our lawyer.