MAKE YOUR FREE Share Purchase Agreement

What we'll cover

What is a Share Purchase Agreement?

A Share Purchase Agreement (or ‘SPA’) sets out the terms and conditions relating to the sale and purchase of shares in a company. This SPA should only be used where the whole share capital in a company is being sold. Share Purchase Agreements are not the same as Asset purchase agreements, in which only assets are bought, as opposed to the whole operating business of the target company.

For more information, read Share purchase agreements.

When should I use a Share Purchase Agreement?

Use this Share Purchase Agreement:

-

if both the seller and buyer are private limited companies

-

if you want to sell or buy the entire share capital in a private limited company

-

to formalise the share sale in an Agreement

-

to include restrictions on the seller after the share sale

Sample Share Purchase Agreement

The terms in your document will update based on the information you provide

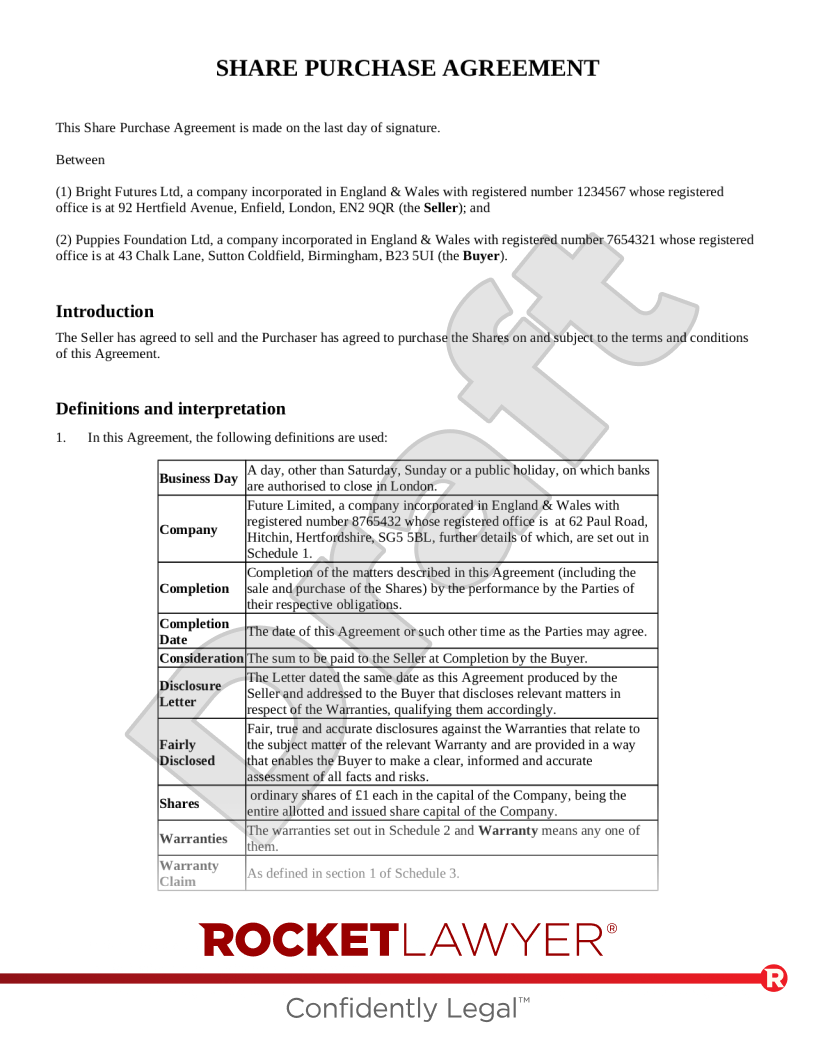

SHARE PURCHASE AGREEMENT

This Share Purchase Agreement is made on the last day of signature.

Between

(1) , a company incorporated in with registered number whose registered office is at , (the Seller); and

(2) , a company incorporated in with registered number whose registered office is at , (the Buyer).

Introduction

The Seller has agreed to sell and the Purchaser has agreed to purchase the Shares on and subject to the terms and conditions of this Agreement.

Definitions and Interpretation

- In this Agreement, the following definitions are used:

Business Day | A day, other than Saturday, Sunday or a public holiday, on which banks are authorised to close in London. |

Company | , a company incorporated in with registered number whose registered office is at , , further details of which, are set out in Schedule 1. |

Completion | Completion of the matters described in this Agreement (including the sale and purchase of the Shares) by the performance by the Parties of their respective obligations. |

Completion Date | The date of this Agreement or such other time as the Parties may agree. |

Consideration | The sum to be paid to the Seller at Completion by the Buyer. |

Disclosure Letter | The Letter dated the same date as this Agreement produced by the Seller and addressed to the Buyer that discloses relevant matters in respect of the Warranties, qualifying them accordingly. |

Fairly Disclosed | Fair, true and accurate disclosures against the Warranties that relate to the subject matter of the relevant Warranty and are provided in a way that enables the Buyer to make a clear, informed and accurate assessment of all facts and risks. |

Shares | ordinary shares of £1 each in the capital of the Company, being the entire allotted and issued share capital of the Company. |

Warranties | The warranties set out in Schedule 2 and Warranty means any one of them. |

Warranty Claim | As defined in section 1 of Schedule 3. |

- In this Agreement, unless the context means a different interpretation is needed:

- including means “including without limitation”;

- words denoting the singular include the plural and vice versa and words denoting one gender includes all genders;

- a person includes firms, companies, government entities, trusts and partnerships;

- a party means a party to this Agreement and includes its assignees and successors in title;

- reference to a Section, paragraph or Schedule of or to this Agreement (and the Schedules form part of this Agreement);

- reference to a statute or statutory provision includes any modification of or amendment to it, and all statutory instruments or orders made under it;

- reference to the time of day is to a time in London; and

- reference to writing or written includes faxes and email but not any other type of electronic communication.

- The headings in this document are for convenience only and do not affect the interpretation of this Agreement.

Agreement for Sale and Purchase of Shares

- Upon the terms of this Agreement, the Seller agrees to sell with title guarantee and the Buyer agrees to purchase the Shares with effect from the Completion Date.

- The Seller hereby warrants, represents and undertakes to the Buyer that the Shares are sold free from any claims, charges, liens, encumbrances, equities and adverse rights of any description and together with all rights and advantages attaching or accruing thereto.

Consideration

- The total Consideration payable by the Buyer to the Seller for the sale and purchase of the Shares shall be £ UK pounds (the Purchase Price), such sale to be satisfied by electronic funds transfer to a bank account nominated by the Seller at Completion to the Seller.

Completion

- Completion of the sale and purchase of the Shares will take place on the Completion Date immediately following execution of this Agreement at such location as the parties may agree.

- On the Completion Date:

- the Seller will deliver to the Buyer:

- a duly executed stock transfer form in respect of the Shares in favour of the Buyer;

- the relevant share certificate(s) (or a lost share certificate indemnity letter in such form as the Buyer shall require in relation to any such issued and delivered, but missing certificate(s);

- a certified copy of the minutes referred to in 8(b) below;

- the statutory registers and other record books of the Company;

- written resignations of all directors (and any secretary appointed) from their respective offices as directors of the Company (executed as a deed in the agreed form) with a written acknowledgement from each that they have no claim whatsoever against the Company for loss of office, damages, pension contribution, loan repayment or any other possible claim; and

- this Agreement and the Disclosure Letter duly executed on behalf of the Seller.

- the Seller shall procure that a duly convened and quorate board meeting of the Company shall be held, at which, it shall be resolved that the transfer of the Shares to the Buyer shall be recognised and (subject to the transfer being duly stamped) approved for registration in the Company’s Register of Members. The Seller shall deliver to the Buyer duly signed minutes of such a meeting, together with all duly completed forms that need to be filed with the Registrar of Companies (including the termination of any director appointment).

- the Buyer will pay the Seller, subject to the Seller performing its obligations in accordance with this Clause 8, at Completion, the total Consideration for Shares (being the sum of £).

- the Seller will deliver to the Buyer:

Warranties

- Subject to Schedule 3, the Seller represents and warrants to the Buyer in relation to the Company that the Warranties as set out on the terms in Schedule 2 as at the Completion Date are true, accurate and not misleading except as Fairly Disclosed in the Disclosure Letter.

- Where any Warranty is qualified in Schedule 2 with the expression ‘so far as the Seller is aware’ or ‘to the best knowledge of the Seller’, or any similar expression, such Warranty is deemed to be qualified by the knowledge of the Seller after having made all reasonable and diligent inquiries.

- The Seller warrants that it has full authority to enter into this Agreement and has obtained all necessary consents.

- The Seller protection provisions, liability thresholds and limitations as set out in Schedule 3 shall apply in respect of the Warranties and any Warranty Claim.

Further Assurance

- Each party (at its own cost) shall, and shall use its reasonable endeavours to procure, execute and perform all such further acts, deeds, documents and things as may be reasonably requested from time to time in order to implement all of the provisions of this Agreement.

Notices

- All notices or other communications under or in connection with this Agreement will be in writing and addressed to the other party.

- Notices will be sent:

- to the Seller at: , .

- to the Buyer at: , .

- Notices will be deemed received:

- by first-class post: 2 Business Days after posting;

- by airmail: 7 Business Days after posting;

- by hand: on delivery; and

- by facsimile: on receipt of a successful transmission report from the correct number.

- Either party may change the address or facsimile number to which such notices to it are to be delivered by giving not less than 5 Business Days’ notice to the other party.

Time of the Essence

- Each time, date or period referred to in this Agreement (including any time, date or period varied by the parties) is of the essence.

Expenses

- The parties agree to pay all of their own costs and expenses in connection with the negotiation, preparation and implementation of this Agreement.

- The Buyer shall be responsible for the payment of United Kingdom stamp duty in respect of the agreement to sell and completion of the sale of the Shares under this Agreement.

Confidential Information

- Neither party shall, without the other party’s prior written consent (not to be unreasonably withheld), disclose:

- information pertaining to this Agreement, including, but not limited to the terms of the Agreement, the Purchase Price, the parties to this Agreement and the subject matter of this Agreement, as well as any written or oral information obtained about the respective parties that is not currently in the public domain;

- any business information or information relating to the customers, suppliers, methods, products, plans, finances, trade secrets or otherwise to the business or affairs or the other party; and

- any information developed by either party in performing its obligations under, or otherwise pursuant to this Agreement, subclauses a, b and c together being the Confidential Information.

- Neither party will use the other party’s Confidential Information except to the extent necessary or required to perform this Agreement.

- Disclosure of Confidential Information may be made to a party’s officers, employees and contractors, professional advisors, consultants and other agents if such disclosure is reasonably necessary, on the condition that the disclosing party is responsible for procuring that the relevant third party complies with its obligations under the clauses headed "Confidential information".

- Confidential Information does not include information which is:

- publicly available, other than as a result of this Agreement;

- lawfully available to a party from a third party who was not subject to any confidentiality restrictions prior to the disclosure of such Confidential Information; or

- required to be disclosed by law, regulation or by order or ruling of a court or administrative body.

- Each party agrees to indemnify the other against any and all harm suffered for any breach of confidentiality.

- On termination of this Agreement, all Confidential Information relating to or supplied by a party which is or should be in the other party’s possession will be returned to the other party or (at the first party’s option) destroyed and certified as destroyed.

- The confidentiality restrictions in this Agreement will continue to apply for a period of five years from the termination of this Agreement.

General

- No amendment or variation of this Agreement shall be effective unless agreed in writing and signed by or on behalf of the parties, or by their authorised representatives.

- Each provision of this Agreement is severable. If any provision of this Agreement (wholly or partly) is or becomes illegal, invalid or unenforceable, that shall not affect the legality, validity or enforceability of any other provision of this Agreement. Where any provision of this Agreement is found to be unenforceable, the Buyer and the Seller will make reasonable efforts to replace such a provision with a valid and enforceable substitute provision, the effect of which, is as close as possible to the intended effect of the original invalid or unenforceable provision.

- No failure or delay by a party to exercise any right or remedy provided under this agreement or by law shall constitute a waiver of that or any other right or remedy, nor shall it prevent or restrict the further exercise of that or any other right or remedy. No single or partial exercise of such right or remedy shall prevent or restrict the further exercise of that or any other right or remedy. A waiver of any right or remedy under this Agreement or by law is only effective if it is in writing.

- This agreement may be executed in any number of counterparts, each of which when executed and delivered (receipt by email shall constitute delivery) shall constitute a duplicate original, but all counterparts together constitute the one agreement.

- This Agreement shall be binding on, and ensure for the benefit of, each party and their respective successors and assigns.

- Neither party shall without the prior written consent of the other party (such consent not to be unreasonably withheld) assign this Agreement either in whole or in part.

- This Agreement and the documents referred to in it constitute the entire agreement and understanding between the parties and supersede all previous agreement between the parties in relation to such matters.

- This Agreement shall be governed by and construed in all respects in accordance with the laws of England and Wales. Each of the parties irrevocably submits to the exclusive jurisdiction of the English and Welsh courts.

The parties have signed the Agreement on the date(s) below:

| _________________________________ | _________________________________ |

and

| _________________________________ | _________________________________ |

SCHEDULE 1 - COMPANY DETAILS

Company Name | |

Date of incorporation | |

Place of incorporation | |

Registered office | , |

Registered number | |

Issued share capital | shares |

Directors |

|

Accounting reference date |

SCHEDULE 2 - WARRANTIES

The Seller

- The Seller is a company duly incorporated and existing under the laws of and is authorised to do business in all jurisdictions within or outside the United Kingdom where this is necessary for the business of the Company at the date of this Agreement.

- The Seller has all necessary power and authority (without the consent of any third party) to enter into and perform its obligations under this Agreement and all other documents to be executed by the Seller pursuant and ancillary to this Agreement.

- The Seller has no direct or indirect interest in any company or business which has a trading relationship with or which is likely to be or become competitive with the Company.

- The Seller warrants that it has made full and fair disclosure in the Disclosure Letter in all material respects of any matter that could reasonably be expected to affect the Buyer’s decision to purchase the Shares on the terms set out in this Agreement.

The Sale Shares

- The Shares comprise (and will at Completion comprise) the entire issued and allotted share capital of the Company.

- There is no encumbrance on, over, or affecting the Shares.

The Company and Solvency

- The information contained in Schedule 1 is true, complete and accurate.

- The Company is a company duly incorporated or continued, validly existing and in good standing and has all requisite authority to carry on business as currently conducted.

- No order has been made, petition presented or resolution passed for the winding-up of the Company.

- No notice of appointment of or notice of intention to appoint an administrator, has been made or issued in relation to the Company and no administration order or administration application has been made in relation to the Company.

- No receiver or administrative receiver has been appointed over any part of the business or assets of the Company, no application has been made to the court for any such appointment and no power of sale or power to appoint a receiver or administrative receiver under the terms of any charge, mortgage or security over the Company’s assets has become exercisable.

- The Company has not stopped payment, is not insolvent and is not unable or deemed unable to pay its debts (within the meaning given by section 123 of the Insolvency Act 1986).

- No statutory demand has been served on the Company that has not been paid in full or withdrawn.

- There are no claims threatened or pending against the Company by any current or past employee relating to any matter arising from or relating to the employment of the employee.

- The Company is operating in accordance with all applicable laws, rules and regulations in which it is carried on.

- The Company has withheld all amounts required to be withheld under income tax legislation and has paid all amounts owing to the proper authorities.

- The Company does not own any subsidiaries or hold any shares in any other company, nor has the Company agreed to acquire any share or loan capital of any company or any right or interest in the same and is not or has not agreed to become a member of any partnership or other unincorporated association, joint venture or consortium.

Accounts

- The accounts of the Company give a true and fair view of the Company, including the assets, liabilities and commitments of the Company at that date, and its profits and cash flow.

- Since the date of the last accounts provided, the Company has carried out its business in the ordinary and normal course and as a going concern in the same manner as in the previous periods, has not declared or paid any dividend, has not issued, repaid or redeemed any share or loan capital or agreed to do the same and there has been no adverse change in the Company’s trading position or any event occur which is likely to give rise to such change.

Employment

- The Company has not made any offer of employment to any person which has not yet been accepted, or which has been accepted but where the employment has not yet started.

- There are no claims threatened or pending against the Company by any current or former employee relating to any matter arising from or relating to the employment of the employee.

Insurance

- The Company’s insurance policies are in full force and effect, all premiums payable thereunder, were paid when due. Nothing has been done or omitted to be done which could make any of them void or voidable or which is likely to result in an increase of premiums.

- No claim is outstanding or pending under any of the Company’s insurance policies and no circumstances exist which, so far as the Seller is aware, are likely to give rise to a claim.

Intellectual Property Rights

- The Company is the sole legal and beneficial owner and exclusive user of the Company’s Intellectual Property Rights (IPR), which are valid and enforceable. No third party has been granted or in any manner, asserted any rights (under licenses or otherwise) to use the Company IPR.

- To the best knowledge of the Seller and the officers of the Company, there are no claims of infringement existing against the IPR used by the Company.

- All agreements, options, understandings and other arrangements that relate wholly or partly to Company IPR or systems used or otherwise exploited by the Company (the IPR Agreements) are not the subject of any disputes, claims or proceedings, nor, so far as the Seller is aware, is any IPR Agreement subject to any potential dispute, claim or proceedings.

- The Company owns or is licensed to use all necessary software and it can continue to use any and all computerised records, files and programmes into the foreseeable future in the same manner as before the Closing Date.

Property

- The properties disclosed are the only land and premises owned, used or occupied for the purposes of the Company’s business.

Compliance

- The Company’s business has been conducted in accordance with all applicable laws and regulations of the jurisdictions where the business is carried out.

- All licences and consents required for carrying out the Company’s business are in full force and effect and are not limited in duration or subject to any onerous conditions.

Litigation

- Prior to the date of this agreement, the Company has not been engaged in any litigation, mediation, arbitration, dispute resolution or criminal proceedings and there are no such proceedings pending, threatened or expected, or facts or circumstances which are likely to give rise to such proceedings involving the Company.

- There is no outstanding order, judgment, award or decision given by any court, tribunal, arbitrator or regulatory body in relation to the Company.

Tax

- The Company has duly and on a timely basis, submitted all returns, supplied all information, made all statements and disclosures and given all notices to any relevant tax authority as reasonably requested or required by law to be made for the purposes of tax within any applicable time limits.

- All such returns, information, statements, disclosures and notices were when submitted and remain at the date of this Agreement complete, correct and accurate in all respects.

- The Company is not and has not in the past been involved in any dispute with any tax authority, or been the subject of any investigation, while there are no facts or circumstances which make it likely that the Company will be the subject of any such investigation.

SCHEDULE 3 - LIMITATIONS ON THE WARRANTIES

- For the purposes of this Schedule 3, a Warranty Claim means a claim for damages, compensation or any other relief by the Buyer under any warranty set out in Schedule 2 (Warranties), in respect of any event, matter or circumstance which is inconsistent with, contrary to, or involves, relates to or is otherwise a breach of, any of the Warranties. Warranty Claims means more than one of them.

- The following provisions of Schedule 3 shall, subject to their terms, limit the liability of the Seller in relation to a Warranty Claim, except where:

- a Warranty Claim is made in respect of paragraphs 1, 2, 7, 8 & 9 of Schedule 2; and

- such Warranty Claim arises as a result of dishonesty, fraud, wilful concealment or wilful misconduct on the part of the Seller.

- The Seller shall not be liable for any Warranty Claim unless written particulars of it are made, the nature of the breach and the amount claimed shall have been given to the Seller within the period of 2 years immediately following the Completion Date.

- The maximum aggregate liability of the Seller in respect of all Warranty Claims shall not exceed under this Agreement.

- The Seller shall not be liable to the Buyer in respect of a Warranty Claim if:

- the Warranty Claim relates to any loss for which is Buyer is indemnified by insurance in force on or after the date of this Agreement and such loss suffered by the Company has been recovered by the Company under such insurance; or

- the Warranty Claim in question or the breach on which the Warranty Claim is based was fairly disclosed in accordance with this Agreement.

- When the Buyer becomes aware that it or the Company has any claim against or a claim is made by a third party in relation to any matter which the Buyer has given notice to the Seller under paragraph 3, the Buyer shall:

- not make any admission of liability or agreement with such third party in relation to such proceedings without prior consultation with and the agreement of the Seller;

- take such action to avoid, dispute, resist, appeal or contest the proceedings as the Seller may reasonably request; and

- make available to the Seller all information reasonably required and available to enable the Seller to avoid, dispute, resist, appeal or contest the proceedings and to take copies of such information at the Seller’s expense, provided that the Buyer shall not be obliged to take any action if such action is, in the reasonable opinion of the Buyer, likely to prejudice materially the Company or the Buyer.

- Nothing in this paragraph shall in any way diminish the Buyer’s common law obligations to mitigate any loss which might be the subject of a Warranty Claim.

About Share Purchase Agreements

Learn more about making your Share Purchase Agreement

-

How to make a Share Purchase Agreement

Making a Share Purchase Agreement online is simple. Just answer a few questions and Rocket Lawyer will build your document for you. When you have all of the details prepared in advance, making your document is a quick and easy process.

To make your Share Purchase Agreement you will need the following information:

Party details

-

What are the details of the seller company (ie the name, registered number and address of the company selling the shares)?

-

Who will sign the SPA on the seller company’s behalf?

-

What are the details of the buyer company (ie the name, registered number and address of the company buying the shares)?

-

Who will sign the SPA on the buyer company’s behalf?

-

What are the details of the target company (ie the name, registered number and address of the company being purchased)?

Target company

-

What is the date of incorporation of the target company?

-

Was the date of incorporation before 1 October 2009?

-

If the target company was incorporated before 1 October 2009, what is its authorised share capital?

-

-

What is the target company’s issued share capital?

-

What are the details of any company directors?

-

What is the target company’s accounting reference date?

Sale

-

Does the seller agree to sell the shares with a full or limited title guarantee?

-

What is the purchase price for the shares?

-

After the sale is complete, what is the seller restricted from doing and, where relevant, for how long and in what areas?

Notices

-

To what address will any notices or other communications made to the seller under the Agreement be sent?

-

To what address will any notices or other communications made to the buyer under the Agreement be sent?

Liability

-

What is the seller’s maximum liability in respect of warranty claims?

Jurisdiction

If the seller, the buyer, or the target company are based in Scotland, which country's laws will apply to this Agreement?

-

-

Common terms in a Share Purchase Agreement

SPAs are used to finalise terms relating to the sale and purchase of shares in a company. To achieve this, this SPA template covers:

Parties

The start of the SPA provides details of the parties to the Agreement. It sets out who the seller and buyer companies are and clarifies that the date of this Share Purchase Agreement is the day of the last signature.

Introduction

This section sets out that the seller had agreed to sell the shares and that the buyer has agreed to purchase the shares in accordance with the terms of the Agreement.

Definitions and interpretation

This section provides the meanings of certain key terms used throughout the Agreement. Examples include ‘Company’, ‘Completion’, ‘Consideration’, ‘Shares’ and ‘Warranties’.

Agreement for sale and purchase of shares

This section outlines the agreement for the sale and purchase of the target company’s shares. Specifically, it clarifies that the seller will transfer the shares to the buyer on completion of the purchase and explains on what guarantee (full or limited) the shares are being transferred.

This section sets out what the purchase price for the shares is and how it should be paid.

Completion

This section sets out when the sale will be finalised (ie completed) and what steps the seller and buyer must take on completion.

Warranties

This section sets out certain warranties the seller makes to the buyer in relation to the shares and the target company. Warranties are essentially legally enforceable promises. This section makes reference to Schedules 2 and 3, which provide the specific warranties applicable to this Agreement and limitations to those warranties. For more information, read Warranties in share purchase agreements.

Restrictive covenants

This section will only appear if the seller is restricted from doing certain things after the sale of the shares. For example, setting up a competing business or dealing with the buyer's customers. If relevant, this section provides details on the specific restrictions placed on the seller. This includes their time limitations and geographical limitations.

For more information, read Non-solicitation and restrictive covenants.

Further assurance

This section requires both parties to (at their own cost) take all necessary steps to implement the provisions of the Agreement. This includes obtaining further documents and performing certain essential tasks.

Notices

This section sets out how any notices and other communications made under this Agreement must be sent to the buyer and seller. This includes details on:

-

all notices needing to be made in writing

-

the addresses all communications should be sent to

-

when notices will be deemed to have been received by the other party

Time of the essence

This section highlights that time is of the essence and that every time period mentioned in this Agreement is important and should be complied with.

Expenses

This section sets out that the parties will pay their own costs and expenses in connection with the negotiation, preparation and implementation of this Agreement. It also states that the buyer is responsible for the payment of stamp duty on the share purchase.

Confidential information

This section explains that both parties may have access to the other’s confidential information and explains that neither shall disclose this information without the other’s prior written consent. This section also provides details on when information will not be considered confidential and how it should be treated after the Agreement ends.

General

This section covers various other points of law that govern how this Agreement operates. These are often known as ‘boilerplate clauses’ and include:

-

only allowing amendments and variations to the Agreement to be made in writing

-

the SPA constituting the entire agreement between the parties

-

the jurisdiction of the Agreement (ie which country’s legal system must be used to resolve any disputes)

Schedule 1 - company details

This schedule sets out details relating to the target company (ie the company which is being sold and bought). This includes its date of incorporation, the names of its directors, its issued share capital and its accounting reference date.

Schedule 2 - warranties

This schedule sets out the warranties the seller is making to the buyer in relation to the shares. Warranties are contractual statements given by a seller to a buyer, assuring the buyer that a certain state of affairs exists. Warranties are a crucial part of a SPA as they allocate risk and liability between the parties.

For more information on these warranties and what they mean, read Warranties in share purchase agreements.

Schedule 3 - limitations on the warranties

This schedule should be read together with Schedule 2 as it provides limitations on the warranties made in Schedule 2. These limitations seek to protect the seller by limiting the scope of the warranties made.

If you want your Share Purchase Agreement to include further or more detailed provisions, you can edit your document. However, if you do this, you may want a lawyer to review or change the Agreement for you, to make sure it complies with all relevant laws and meets your specific needs. Ask a lawyer for assistance.

-

-

Legal tips for making a Share Purchase Agreement

Understand when this document should be used

This Share Purchase Agreement should be used to buy the entire share capital (ie all shares) in a private limited company (LTD). By buying the entire share capital, the buyer buys the company as a whole, along with all of its assets and liabilities. Further, this SPA assumes that both the buyer and seller are LTDs.

Ask a lawyer for assistance if:

-

the seller and/or buyer is not a company (eg where a single shareholder is selling their share capital)

-

you want to buy some shares in a company

-

the target company isn’t an LTD (ie if it is a public company)

If you want to buy certain business assets only (eg some company equipment), you should use an Asset purchase agreement instead of an SPA.

For more information, see the FAQ ‘What is the difference between a share sale and an asset sale?’.

Remember to comply with all relevant post-completion requirements

After the completion (ie signing) of the Agreement, the buyer will need to take several different steps. These include:

-

filing all necessary notices with Companies House (eg notices of directors’, secretaries’ and auditors’ appointments)

-

Integrating the target company into the buyer’s business (eg by making the relevant Value Added Tax (VAT), TUPE and payroll changes)

-

notifying Companies House of the change to the target company’s share ownership in its next annual tax return

Understand when to seek advice from a lawyer

Ask a lawyer for advice:

-

if the buyer and/or seller are not companies

-

if you're unsure of the warranties being made

-

if you're unsure of the restrictions being imposed on the seller

-

if you need help with due diligence

-

if you need help making a disclosure

-

on drafting bespoke terms in a Share Purchase Agreement

-

on tax considerations when buying shares

-

if the target company is based outside of England, Wales and Scotland

-

if the target company is a public company

-

Share Purchase Agreement FAQs

-

What is included in a Share Purchase Agreement?

This Share Purchase Agreement template covers:

-

details of the target company (ie the company being purchased)

-

the purchase price for the shares

-

when completion of the Agreement will take place

-

warranties made by the seller and buyer

-

representations made by the seller and buyer

-

restrictions on the seller post-completion

-

notices

-

-

Why do I need a Share Purchase Agreement?

A Share Purchase Agreement helps finalise all the agreed terms and conditions of the sale of the shares in a company.

A Share Purchase Agreement can be necessary to ensure that the parties are aware of any representations or warranties made about the target company. When a buyer is purchasing all of the shares in a company, they are also buying all of the obligations and responsibilities of the company, including any debts or liabilities.

As a share buyer, use this SPA to make sure the seller enters into some contractual promises about the company which will continue to bind them after the sale. You should use this SPA where both the seller and buyer are companies (ie not private individuals). Ask a lawyer for assistance if this is not the case.

-

What are warranties in a Share Purchase Agreement?

Warranties are statements of fact, or promises, that parties give to assure the another party that certain conditions are true. Warranties are very important in any Share Purchase Agreement as they reduce the risks imposed by a share sale for the buyer.

One of the main aims of the warranties is to provide the buyer with a potential remedy if a statement about the target company turns out to be untrue, which changes the true value of the target company.

Warranties can highlight any information that the buyer ought to know and which could affect the value of the company or even the buyer’s decision to buy the business. Using warranties also acts as an information-gathering mechanism for the buyer and assists in any due diligence undertaken prior to completing the share sale. This can give the buyer some comfort in the event that the business is not as the seller has represented it to them, eg if the company has some hidden problems or faces upcoming litigation.

If a warranty turns out to be untrue, for example, a warranty that the target company is not currently in any litigation, then this can result in a successful claim for damages. The buyer will need to show that the breach of warranty resulted in a substantial loss (ie a reduction in the value of the target company).

For more information, read Warranties in share purchase agreements.

-

Does the seller have to give warranties on the sale of a business?

The law does not provide much protection for buyers and sellers in a commercial context (ie in business transactions). There is a well-known principle of 'caveat emptor' (or buyer beware), which states that it is the buyer's obligation to know all of the facts and details of what they are buying.

As a result, buyers would seek to protect themselves by obtaining all of the information about the company and receiving assurances from the seller relating to the assets and liabilities of the target company. Therefore, warranties are very important provisions in most, if not all, Share Purchase Agreements.

Ask a lawyer if you need assistance understanding any warranties contained within this Agreement.

-

What is a disclosure letter?

A disclosure letter gives a seller the opportunity to make ‘disclosures’ against the warranties which the buyer will require the seller to give.

The seller can make two types of disclosures: general and specific disclosures.

General disclosures cover certain matters that appear in public records and/or of which the buyer ought to be aware on the basis of pre-contract enquiries or searches actually made or that a buyer would normally make. These should be included in the letter.

Specific disclosures cover anything which, if not disclosed, would constitute a breach of warranty. The specific disclosures should be made by reference to the warranties themselves. These will be for you to include after you have created your Asset Purchase Agreement document. Ask a lawyer if you have any questions about how to draft these.

If a seller makes inadequate disclosures, it may face breach of warranty claims, which could allow the buyer to recover some or even all of the purchase price.

-

What is consideration?

The consideration is the purchase price payable by the buyer for the shares in the target company. When completing a share sale it's important that the true value of the target company is reflected in the Agreement. It's usual for the parties to obtain a valuation of the target company through completion accounts and references to annual and management accounts. This helps the purchase price to be adjusted in the event that the value of the target company changes.

-

What are restrictive covenants?

The buyer of a share sale may want to impose restrictions on the seller after the sale is completed. Typical restrictions include the seller agreeing to not be involved in any competing businesses and to not solicit any customers, suppliers, or employees of the target company. These restrictions are included to protect the buyer and the target company. A buyer will want to ensure that the seller doesn't do anything after the completion of the sale that could adversely affect the value of the target company.

However, it's important to ensure that the restrictions are reasonable and are not a restraint of trade in order for them to be enforceable. Therefore, the restrictions should be limited in terms of scope (both geographically and functionally) and time. The usual duration is between 1 and 5 years.

For more information, read Non-solicitation and restrictive covenants.

-

What is a limitation of liability?

Limitation of liability clauses limit the amount one party has to pay another party if that party suffers loss because of the first party’s breach of a contract between the parties. It is usual for a seller to limit its liability under a Share Purchase Agreement, specifically in relation to the warranties, and this is usually accepted by the buyer. For more information, read Limitation of liability clauses.

-

What is the difference between a share sale and an asset sale?

If the buyer buys a company by means of a share sale and purchase, the buyer takes on the shares in the target company. The buyer will acquire the target company with all of its assets and liabilities. A share sale can be more straightforward than an asset sale, although extensive due diligence will need to be conducted to uncover and investigate any liabilities that will come with the company that’s being purchased. In an asset sale, any liabilities will generally be left behind with the target company from which the assets were purchased.

If a buyer buys a business as a going concern by means of an asset sale and purchase, all of the individual assets of the business concerned will be transferred to the buyer together with the goodwill of the business. This means that the buyer can decide which assets in the target company it will purchase and can leave behind any liabilities, such as debts and pending litigation.

For more information, read Share purchase agreements and Asset purchase agreements.

-

What restrictions are there on transferring shares?

Generally, shareholders (ie members) have a right to transfer or sell their shares to whomever they want. However, certain provisions in a company’s Articles of association may restrict this right where there is:

-

a provision that the board of directors should have the power to refuse the register of shares, or

-

a pre-emption clause which obligates a member to first offer to sell their shares to other specified members or directors

In these cases, you should check your articles of association or Ask a lawyer if you require assistance in reviewing your documents.

-

-

Do I need to file this Agreement with Companies House?

The Share Purchase Agreement is a private document and there is no requirement to file it with Companies House. However, you should notify Companies House of the change of share ownership in the target company’s next annual tax return.

Our quality guarantee

We guarantee our service is safe and secure, and that properly signed Rocket Lawyer documents are legally enforceable under UK laws.

Need help? No problem!

Ask a question for free or get affordable legal advice from our lawyer.